I’ve been trying to figure out NFT trading for months. The numbers are crazy. Just in October, NFT trading volume exceeded $15 billion. 15. Billion. Dollars. It’s even crazier when you count how many unique users are involved in these transactions. In October, there were approximately 800,000 traders. The average deal value was $861.

A staggering amount of money. Very few traders. Unprecedented potential for growth.

As I stared in awe at these numbers, I kept asking myself: Is money the only determining factor here? Or are there other factors at play? Thus, I’ve gone through a few behavioral economy and psychology books, and have come up with a few other motives that aren’t necessarily money-related, that should shed light on NFT traders’ true motivations. And here they are:

- It’s not real money

- Gambling with the house money

- Social relatedness

- The endowment effect

- Scarcity effect

- Fear of regret and loss

Are you ready?

Let’s begin.

1. It’s not real money

Meet cryptopunk #7252. This is a 24 by 24 pixel art picture. Minted on the Ethereum blockchain and has unique visual characteristics, just like every Cryptopunk in that 10,000-piece collection.

There was a change of ownership of this picture in August 2021. The transaction amount was $6.86 million. This is the price of a luxury flat in an expansive city. However, to be precise, dollars were not a part of the deal. The money transferred was 1600 ETH. Same thing? Not exactly.

When trading NFTs, The Ethereum coin acts like a casino chip. Psychologically, it is much easier to spend casino chips than real money. That is why casino chips exist.

When we gamble with casino chips or ETH, we create an abstraction layer between the physical or digital asset and the value it represents. We are less afraid to lose chips than real money, hence the phrase “all in” is something we hear commonly in casino halls, but not so much in real life. NFT traders use the term “ape in” to describe a dealer who goes berserk on a collection and spends a lot of ETH on it.

Casino chips and ETH have more similarities. In a casino, for instance, the first thing you do is exchange dollars for chips. The same applies to NFT trading. To trade, one needs to install a digital wallet on their browser and wire some ETH to it to start trading. Fiat currency won’t work.

Furthermore, in a typical casino, dollars can be exchanged for chips at various locations. However, you can only exchange chips for dollars at the counter at the exit. The same goes for crypto. Easy to buy. Not so easy to cash out. That’s the case at least in Israel. Banks are reluctant to accept crypto fortunes.

In conclusion, folks who buy ETH to trade NFTs are likely to stay in the game for a long time, not hurrying to cash out their profits.

2. Gambling with the house money

When it comes to NFT trading, the number one rule is: never play with money you can’t afford to lose. This is very good advice. But psychologically, this advice plays a little trick on us. Many people who convert fiat to ETH feel that they have already lost money. In their eyes, every number above zero is a gain. In this state of mind, people will be willing to risk their money right away.

In the case of a big windfall, this psychological effect is amplified. Let’s say you made 10X profit on your last NFT trade. Would you take the profit? Would you use it to make more deals? You will probably pick the second option since you are now “gambling with the house money.”

Social relatedness

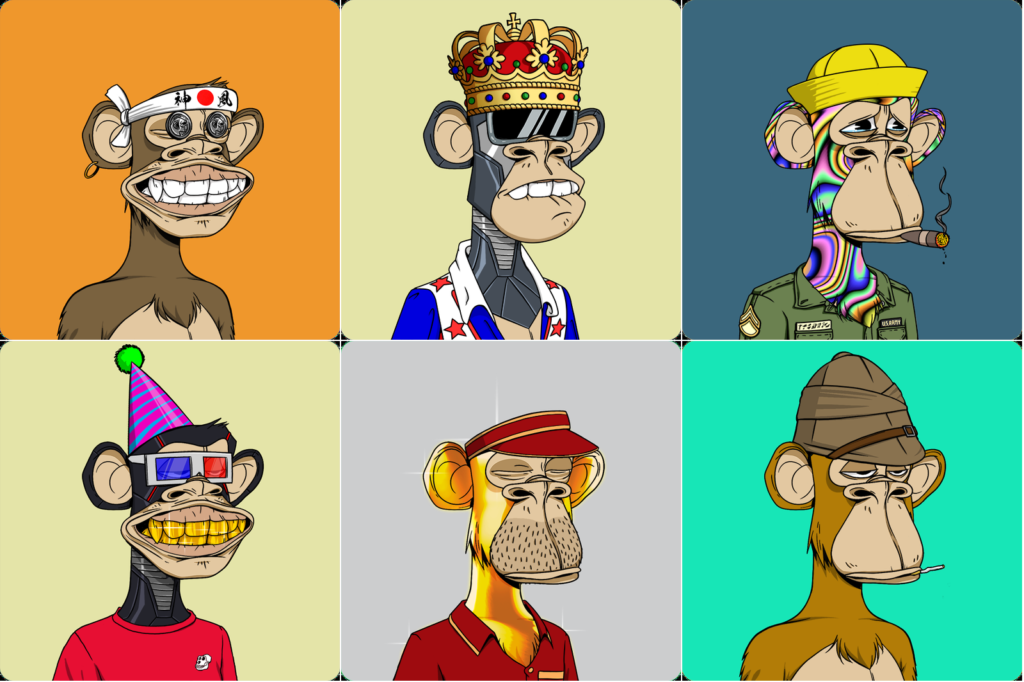

Money is a huge factor in NFT trading. However, it is not the only one. The best NFT projects out there are heavily dependent on communities that foster a sense of belonging among their participants.

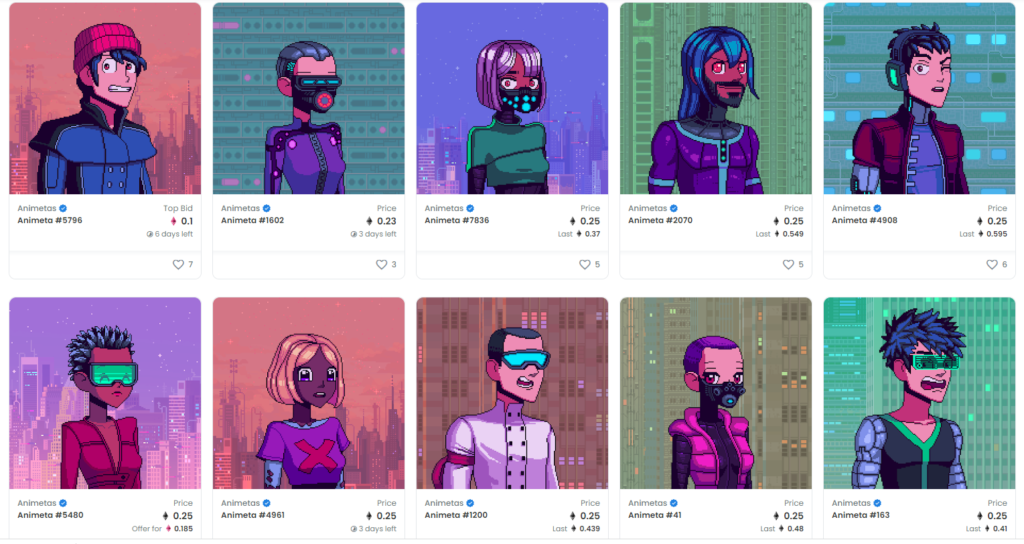

Animetas is a good example. A collection of 10101 wonderful avatars in pixel art. Since its launch at the end of July 2021, this project has amassed more than $35 million dollars on the secondary market. Not bad for a brand that’s just four months old. Nevertheless, you won’t find many results when searching for that project on Google. Only a few thousand people in the know are aware of its existence, despite the large sales volume. It is because of this exclusivity that Animetas members feel unique.

Animeta ownership entails being a member of an exclusive club that cannot be expanded. Membership comes with perks. An AMA with John Romero (ID software, Doom) was held in the group’s closed discord channel a while back. It was only open to Animeta owners. New hovercars NFTs will be released next week. Animeta owners will automatically receive one in their wallets. If this drop will be successful as the Animeta team hopes, all members will make money. Furthermore, they will become more engaged with the brand.

A membership, however, offers more than just perks. The fan art in the Animetas community is amazing. A wide array of beautiful works are being submitted regularly to Twitter and to Animeta’s discord channel, ranging from pixel art to professionally rendered 3d versions of animetas. One Animeta owner has started to write a book about his Animeta. He has already written 300 pages. This level of engagement is unprecedented, especially for a community of a few thousand members.

The endowment effect

According to the endowment effect, people are more likely to retain an object they own than acquire the same thing if they do not own it. Imagine you own an old bottle of wine, and one day you find out its value is around $350.

Would you be willing to sell the bottle? If you don’t need the money urgently, you will probably keep the bottle. However, would you buy a bottle of wine for that amount? Probably not.

A similar pattern can also be seen in the world of NFT trading. Whenever someone buys an NFT, she can set the price as high as she wants. NFTs are often given a high price tag due to emotional attachment and endowment effect. When owners of a limited collection celebrate the endowment effect and don’t sell cheap or at all, the floor level of the collection is rising.

I’ve heard a story of someone who bought an NFT for a minting price, and put a tag price of 20 ETH on it. It was a super rare avatar and she didn’t want to sell. Within 24 hours, it was sold. Her immediate reaction was sadness for the loss of her NFT.

The scarcity effect

Who doesn’t like rare items? (That’s a rhetorical question. We all do). Researchers have shown that people value something more only because there is less of it available. Crypto currencies in general (only 21 million Bitcoins) and NFT in particular are driven by scarcity. It is the first time in history that a generative series of digital assets can be created and listed in order to ensure ownership.

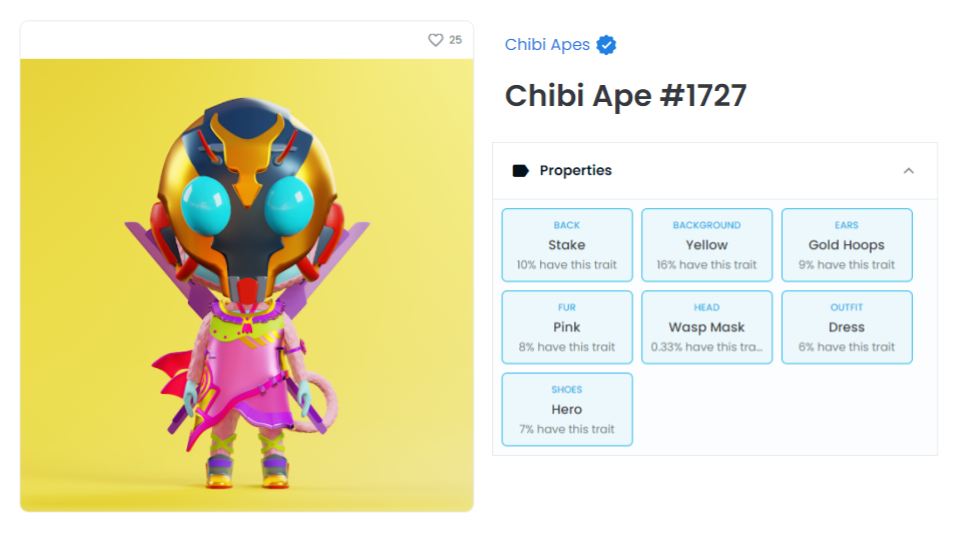

NFT collectibles thrive on scarcity because of these factors. Each avatar / NFT has its own traits, so potential buyers can easily determine how rare an avatar is. The rarer the avatar, the better.

The fear of regret

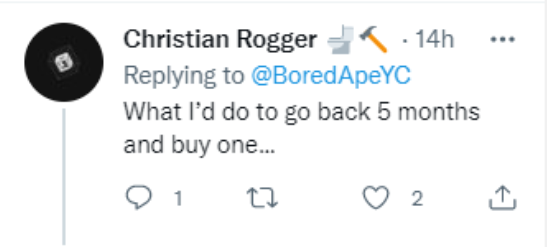

A crippling fear of doing or not doing something, and then regretting it later. The previous psychological traits discussed can be seen embedded in the fear of regret, or its relative, FOMO.

Take Dany, for instance. Dany is interested in trading NFTs. Having heard about the huge gains, he decides to check out the water for himself. Daily, he checks NFT markets like Opensea to see if it’s a good time to buy, what he should buy and how much he should risk. Ultimately, if prices are on the rise, the fear of regret may be what pulls a transaction through. Now or never. Suppose the prices drop?

The first sentiment would be something along the lines of, wow, I’m so lucky that I didn’t go in. However, when prices go up again, the fear of regret will strike again. Dany will make his first transaction soon.

So what’s next?

Crypto and NFT markets are not ready for the masses yet. I lost $250 on gas a few weeks ago. My $250 just vaporized into thin air. I didn’t even complete the transaction. I lost it for nothing, because I failed to pay attention. If it happened to me, I’m sure it happens to many people, all the time.

The market is complex. Confusing. Dangerous. It is still populated by early adopters. Due to too much money, lack of proper regulation, and many, many scams, I believe the NFT market will soon lose a lot of height.

Nevertheless, I’m a firm believer in the idea. Our lives are becoming more and more digital. My generation grew up without mobile phones. It is unimaginable to us today. My son knows how to use an iPad. The boy is 5 years old and has been doing it for two years now (don’t blame my parenthood, it’s Covid. Sort of.).

In a digital world, digital objects have more significance than physical ones. Under the blockchain’s custody, the world can view our digital assets and know they belong to us.

NFTs are not going anywhere. In the next few years, big gaming companies will harness blockchain ideas, which will allow players to truly own the assets they play with and become part of a game’s economy.

What would be the taxation of NFTs? Should NFTs be governed? I don’t know. But we are all going to find out, sooner than later.

Resources

- Daniel Kahneman, Jack L. Knetsch & Richard H. Thaler, “Anomalies: The Endowment Effect, Loss Aversion and Status Quo Bias”

- Richard H. Thaler & Eric J. Johnson, “Gambling With The House Money And Trying To Break Even: The Effects of Prior Outcomes on Risky Choice”

- Richard M. Ryan & Edward L. Deci, “Self-Determination Theory and the Facilitation of Intrinsic Motivation, Social Development and Well-Being”

- Daniel Kahneman & Amos Tversky, “Prospect Theory: An Analysis of Decision under Risk”